Hello. Today we look at the global tax debate, a big day for economic data and decisions plus what central banks taking on climate change means for interest rates.

Taxing Times

The global tax net is tightening around the world’s wealthiest.

Days after Group of Seven finance ministers signed up to a global minimum corporate tax and to ensuring firms pay more where they are making money, their bosses are set to rubber-stamp the pact at a summit in southern England.

But executives and the companies they run have been piling up the money for a while now. Why the change in tone from governments?

Ben Steverman, Laura Davison and William Horobin run through some of the reasons in an article reviewing the debate.

- For one thing, the amassing of wealth has been eye-watering. The world’s wealthiest 500 individuals are now worth $8.5 trillion, up more than 40% in a year ravaged by a pandemic. Facebook, Apple, Amazon, Netflix, Google and Microsoft collectively skirted approximately $100 billion in U.S. taxes from 2010 to 2019, according to Fair Tax Mark.

- Secondly, the feeling of inequity is growing. Many corporations are now paying lower levies than grocery clerks thanks to the leaky tax system and a decline in effective tax rates. That’s stirring resentment among voters, leaving politicians under pressure to act.

- Thirdly, governments need the cash having run up massive budget deficits to fight the economic fallout from the coronavirus.

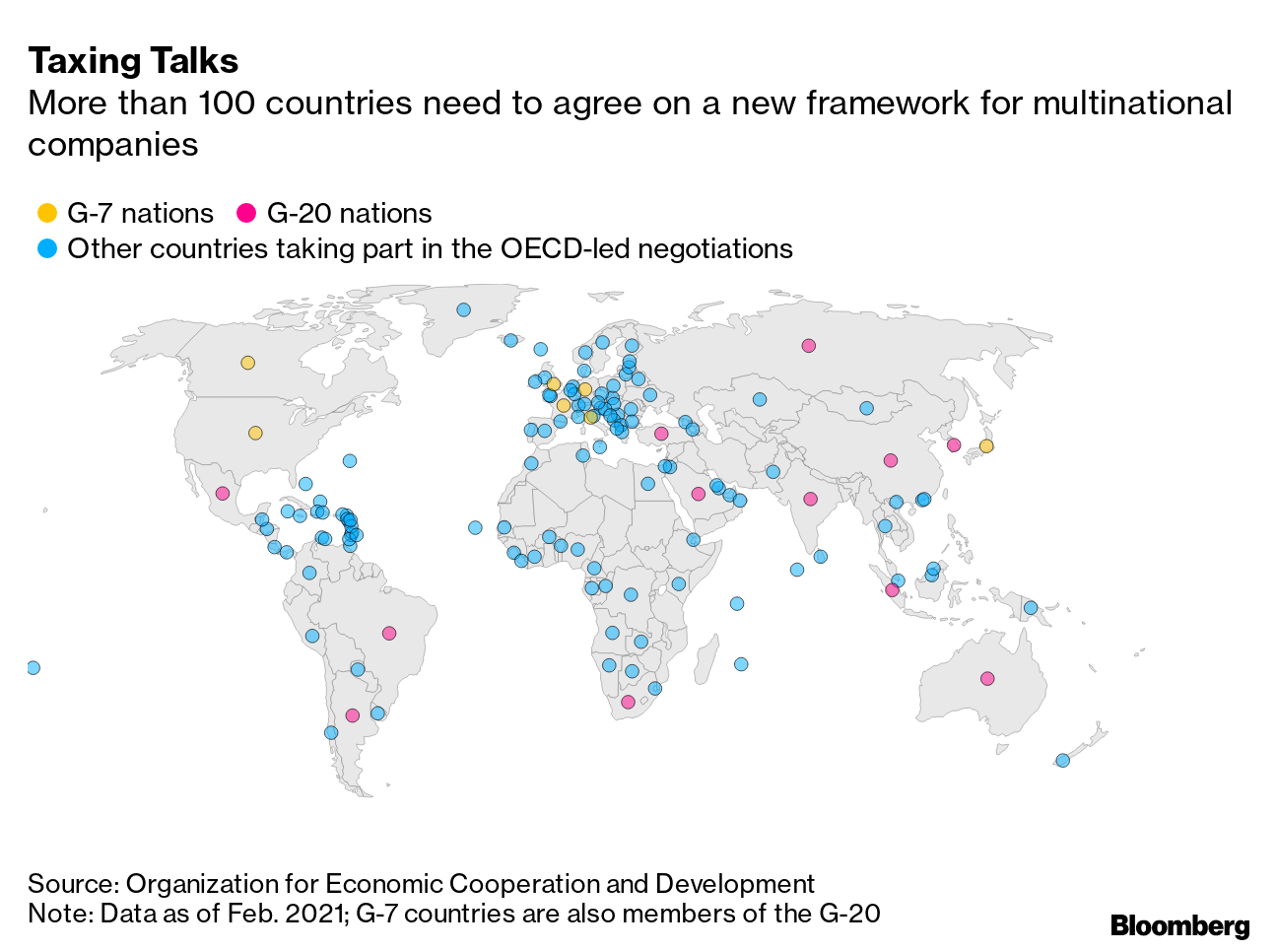

Taxing Talks

More than 100 countries need to agree on a new framework for multinational companies

Source: Organization for Economic Cooperation and Development

“It is very easy for multinationals and the richest people to escape tax,” said Philippe Martin, a former adviser to French President Emmanuel Macron who now heads the Conseil d’Analyse Economique. “There is a window of opportunity, a turning point at which they are realizing they need tax power and they need to spend more.”

Of course, stitching together a global accord isn’t easy. Already the U.K. is exploring exemptions for financial firms and China may also lobby for relief. Hungary’s president calls the whole idea “absurd.”

But the trend certainly favors the tax collector.

The Economic Scene

Increasing Imbalance

China’s trade surplus with the U.S. continues to increase

Source: China’s General Administration of Customs

Relations between the world’s two biggest economies are becoming less frosty, though it would be a stretch to say they’re warming. In a phone call Thursday morning Asia time the Chinese and U.S. commerce ministers “exchanged views frankly and pragmatically on relevant issues and mutual concerns,” according to a Chinese government statement.

But it’s not quite a rebirth of “Chimerica.” The trade relationship with China has “significant imbalance” and the Biden administration is committed to leveling it, U.S. Trade Representative Katherine Tai said on the weekend before a meeting of Asia-Pacific ministers. Still, the Thursday call was the third between senior officials in recent weeks, after China’s Vice Premier Liu He spoke with Tai and Treasury Secretary Janet Yellen. And talking is a start.

Today’s Must Reads

- Coming up | The European Central Bank will decide today how much monetary stimulus the euro zone needs as it leaves lockdowns. In the U.S., investors eye the latest consumer price index to gauge the inflation risk with economists expecting an annual advance of 4.7%.

- Calming words I | Commerce ministers from China and the U.S. agreed to push forward trade and investment links in their first call since the start of the Biden administration.

- Calming words II | China’s central bank Governor said consumer inflation will likely stay below the government’s target this year and monetary policy must remain stable, downplaying inflation concerns.

- Pricey protein | Americans have been eating more protein in recent years, but costs for all the major sources of it are soaring. If that’s not bad enough, tomato sauce on your spaghetti may be harder to come by amid a global shortage of steel sheets to make cans.

-

Inflation linguistics | Many companies are talking inflation, but not in easy to spot ways. Procter & Gamble isn’t raising prices, it’s “taking pricing.” Unilever says it’s been “very active with pricing.” The prize for creativity is Lowe’s, which is “elevating our pricing ecosystem.”

-

No bubble | U.S. home prices are rising at an even faster pace than in the lead-up to the last housing crisis, but by some key measures there’s less risk of a blowout.

Need-to-Know Research

Central banks are taking on climate change and that might mean higher interest rates. A new analysis by Nicholas Z. Muller of the Tepper School of Business introduces a green interest rate attuned to the pollution caused by different levels of pollution. It proposes a reallocation of consumption from periods when output is pollution intensive to when output is cleaner. When economies are cleaning up, the green rate would exceed the rate that would otherwise prevail. From 1957 to 2016, the difference was 50 basis points.

On #EconTwitter

Returning to normal:

Read more reactions on Twitter

Enjoy reading the New Economy Daily?

-

Click here for more economic stories

-

Tune into the Stephanomics podcast

-

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world’s most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here.